What Is Home Agains Current Annual Fee?

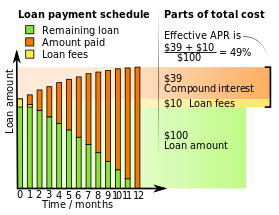

Parts of full cost and effective APR for a 12-month, 5% monthly interest, $100 loan paid off in as sized monthly payments.

The term almanac percent rate of charge (Apr),[ane] [ii] corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR),[3] is the interest charge per unit for a whole year (annualized), rather than just a monthly fee/rate, as practical on a loan, mortgage loan, credit carte, etc. It is a finance accuse expressed as an annual rate.[4] Those terms take formal, legal definitions in some countries or legal jurisdictions, only in the United states of america:[3]

-

- The nominal April is the unproblematic-interest rate (for a yr).

- The effective APR is the fee+compound interest rate (calculated beyond a twelvemonth).[iii]

In some areas, the annual percentage charge per unit (APR) is the simplified analogue to the effective interest charge per unit that the borrower will pay on a loan. In many countries and jurisdictions, lenders (such every bit banks) are required to disembalm the "cost" of borrowing in some standardized manner as a form of consumer protection. The (constructive) APR has been intended to make information technology easier to compare lenders and loan options.

Multiple definitions of constructive Apr [edit]

The nominal Apr is calculated as: the rate, for a payment menstruation, multiplied past the number of payment periods in a yr.[3] However, the verbal legal definition of "effective Apr", or EAR, can vary greatly in each jurisdiction, depending on the type of fees included, such every bit participation fees, loan origination fees, monthly service charges, or late fees. The constructive Apr has been called the "mathematically-true" interest rate for each yr.[5] [six]

The computation for the constructive Apr, every bit the fee + compound interest rate, can as well vary depending on whether the upward-front fees, such as origination or participation fees, are added to the unabridged corporeality, or treated as a short-term loan due in the first payment. When start-up fees are paid as commencement payment(s), the balance due might accrue more than involvement, as being delayed by the extra payment flow(s).[7]

There are at least 3 ways of calculating effective annual percentage rate:

- by compounding the interest rate for each yr, without because fees;

- origination fees are added to the residual due, and the total amount is treated as the basis for computing compound interest;

- the origination fees are amortized as a short-term loan. This loan is due in the first payment(due south), and the unpaid residual is amortized every bit a second long-term loan. The extra offset payment(s) is defended to primarily paying origination fees and interest charges on that portion.

For example, consider a $100 loan which must be repaid after one calendar month, plus 5%, plus a $10 fee. If the fee is not considered, this loan has an effective Apr of approximately lxxx% (1.0512 = 1.7959, which is approximately an 80% increase). If the $10 fee were considered, the monthly interest increases by x% ($10/$100), and the constructive April becomes approximately 435% (1.xv12 = v.3503, which equals a 435% increase). Hence there are at least two possible "effective APRs": fourscore% and 435%. Laws vary as to whether fees must be included in APR calculations.

United states of america [edit]

In the U.S., the calculation and disclosure of APR is governed by the Truth in Lending Human action (which is implemented by the Consumer Financial Protection Bureau (CFPB) in Regulation Z of the Human activity). In general, Apr in the U.s. is expressed equally the periodic (for case, monthly) involvement rate times the number of compounding periods in a year[8] (too known as the nominal interest rate); since the April must include certain non-interest charges and fees, it requires more detailed adding. The Apr must be disclosed to the borrower inside iii days of applying for a mortgage. This information is typically mailed to the borrower and the APR is constitute on the truth in lending disclosure statement, which also includes an acquittal schedule.

On July xxx, 2009, provisions of the Mortgage Disclosure Improvement Human activity of 2008 (MDIA) came into outcome. A specific clause of this act refers directly to Apr disclosure on mortgages. Information technology states, if the terminal annual percentage rate April is off by more than 0.125% from the initial GFE disclosure, then the lender must re-disclose and wait another three business concern days before closing on the transaction.

The adding for "close-ended credit" (such as a home mortgage or motorcar loan) can be found hither. For a stock-still-rate mortgage, the APR is thus equal to its internal rate of return (or yield) under an assumption of zero prepayment and zero default. For an adjustable-rate mortgage the APR will also depend on the particular supposition regarding the prospective trajectory of the index rate.

The calculation for "open-concluded credit" (such as a credit card, home equity loan or other line of credit) tin exist found here.

European Marriage [edit]

In the Eu, the focus of Apr standardization is heavily on transparency and consumer rights: «a comprehensible set of data to be given to consumers in proficient time before the contract is concluded and too as part of the credit agreement [...] every creditor has to use this form when marketing a consumer credit in any Member Country» so marketing unlike figures is not allowed.

The European union regulations were reinforced with directives 2008/48/EC and 2011/90/Eu, fully in strength in all member states since 2013.[9] Yet, in the UK the EU directive has been interpreted as the Representative APR.

A single method of calculating the April was introduced in 1998 (directive 98/7/EC) and is required to exist published for the major office of loans. Using the improved note of directive 2008/48/EC, the basic equation for adding of APR in the EU is:

-

- where:

- Chiliad is the full number of drawdowns paid by the lender

- N is the total number of repayments paid past the borrower

- i is the sequence number of a drawdown paid by the lender

- j is the sequence number of a repayment paid by the borrower

- Ci is the cash flow amount for drawdown number i

- Dj is the cash flow amount for repayment number j

- ti is the interval, expressed in years and fractions of a year, between the date of the offset drawdown* and the appointment of drawdown i

- southwardj is the interval, expressed in years and fractions of a twelvemonth, between the date of the first drawdown* and the date of repayment j.

- The EU formula uses the natural convention that all time intervals in ti and sj are measured relative to the date of the first drawdown, hence t1 = 0. Still, whatever other appointment could exist used without affecting the calculated APR, every bit long as it is used consistently: an offset applied to all times simply scales both sides of the equation by the same amount, without affecting the solution for APR.

In this equation the left side is the present value of the drawdowns fabricated by the lender and the correct side is the present value of the repayments made by the borrower. In both cases the present value is defined given the APR equally the interest rate. So the present value of the drawdowns is equal to the nowadays value of the repayments, given the Apr as the involvement rate.

Note that neither the amounts nor the periods betwixt transactions are necessarily equal. For the purposes of this adding, a year is presumed to take 365 days (366 days for leap years), 52 weeks or 12 equal months. As per the standard: "An equal calendar month is presumed to have xxx.41666 days (i.east. 365/12) regardless of whether or not it is a leap twelvemonth." The outcome is to be expressed to at to the lowest degree i decimal place. This algorithm for Apr is required for some but not all forms of consumer debt in the Eu. For case, this EU directive is limited to agreements of €50,000 and below and excludes all mortgages.[10]

In the Netherlands the formula above is too used for mortgages. In many cases the mortgage is not always paid back completely at the end of period N, but for instance when the borrower sells his house or dies. In addition, there is usually only i payment of the lender to the borrower: in the outset of the loan. In that case the formula becomes:

-

- where:

- S is the borrowed amount or principal amount.

- A is the prepaid former fee

- R the rest debt, the corporeality that remains every bit an interest-only loan later on the final cash catamenia.

If the length of the periods are equal (monthly payments) and then the summations can exist simplified using the formula for a geometric serial. Either way, the APR can be solved iteratively only from the formulas in a higher place, apart from trivial cases such every bit Due north=ane.

Additional considerations [edit]

- Defoliation is possible in that if the give-and-take "constructive" is used separately equally significant "influential" or having a "long-range issue", then the term effective April will vary, as information technology is not a strict legal definition in some countries. The April is used to discover chemical compound and simple interest rates.

- APR is also an abbreviation for "Annual Principal Rate" which is sometimes used in the motorcar sales in some countries where the involvement is calculated based on the "Original Principal" not the "Electric current Principal Due", so every bit the Current Primary Due decreases, the interest due does not.

Rate format [edit]

An effective annual involvement rate of x% tin can also be expressed in several means:

- 0.7974% constructive monthly involvement charge per unit, because i.00797412=1.1

- nine.569% annual involvement charge per unit compounded monthly, considering 12×0.7974=nine.569

- 9.091% almanac rate in advance, considering (one.ane-i)÷1.ane=0.09091

These rates are all equivalent, but to a consumer who is not trained in the mathematics of finance, this tin can be confusing. APR helps to standardize how involvement rates are compared, so that a 10% loan is not made to look cheaper past calling it a loan at "ix.1% annually in advance".

The Apr does non necessarily convey the total amount of interest paid over the course of a year: if one pays part of the interest prior to the end of the year, the total amount of interest paid is less.

In the instance of a loan with no fees, the amortization schedule would be worked out past taking the principal left at the terminate of each calendar month, multiplying by the monthly charge per unit and and so subtracting the monthly payment.

This can be expressed mathematically by

- where:

- p is the payment made each catamenia

- P0 is the initial main

- r is the percent charge per unit used each payment

- n is the number of payments

This also explains why a 15-year mortgage and a 30-year mortgage with the same April would accept unlike monthly payments and a different total amount of interest paid. There are many more than periods over which to spread the principal, which makes the payment smaller, simply in that location are just every bit many periods over which to charge interest at the aforementioned charge per unit, which makes the full amount of interest paid much greater. For instance, $100,000 mortgaged (without fees, since they add into the calculation in a different way) over 15 years costs a total of $193,429.80 (involvement is 93.430% of principal), simply over 30 years, costs a total of $315,925.20 (interest is 215.925% of principal).

In addition the APR takes costs into account. Suppose for instance that $100,000 is borrowed with $g quondam fees paid in advance. If, in the 2nd instance, equal monthly payments are fabricated of $946.01 against 9.569% compounded monthly then it takes 240 months to pay the loan back. If the $1000 one-time fees are taken into account and so the yearly interest charge per unit paid is effectively equal to x.31%.

The Apr concept can also be applied to savings accounts: imagine a savings account with 1% costs at each withdrawal and again 9.569% involvement compounded monthly. Suppose that the consummate corporeality including the involvement is withdrawn subsequently exactly one year. Then, taking this 1% fee into business relationship, the savings effectively earned viii.ix% interest that yr.

Money factor [edit]

The APR tin can also be represented by a money factor (besides known equally the lease factor, charter rate, or factor). The money factor is usually given every bit a decimal, for instance .0030. To detect the equivalent April, the money cistron is multiplied by 2400. A money gene of .0030 is equivalent to a monthly involvement rate of 0.6% and an APR of 7.2%.[11]

For a leasing arrangement with an initial upper-case letter cost of C, a residual value at the stop of the lease of F and a monthly involvement rate of r, monthly interest starts at Cr and decreases almost linearly during the term of the lease to a final value of Fr.[12] The total corporeality of interest paid over the lease term of N months is therefore

and the average interest amount per month is

This amount is chosen the "monthly finance fee".[xiii] The gene r/2 is called the "money factor"

Failings in the United States [edit]

Despite repeated attempts past regulators to establish usable and consistent standards, APR does not represent the total cost of borrowing in some jurisdictions nor does information technology really create a comparable standard across jurisdictions. Still, it is considered a reasonable starting point for an ad hoc comparing of lenders.

Nominal April does non reflect the true cost [edit]

Credit bill of fare holders should be aware that most U.Due south. credit cards are quoted in terms of nominal APR compounded monthly, which is non the aforementioned as the constructive annual rate (EAR). Despite the give-and-take "annual" in APR, information technology is not necessarily a direct reference for the involvement charge per unit paid on a stable balance over one year. The more than direct reference for the one-year rate of interest is EAR. The general conversion factor for APR to EAR is , where n represents the number of compounding periods of the Apr per EAR period. As an instance, for a common credit menu quoted at 12.99% APR compounded monthly, the one year EAR is , or xiii.7975%. For 12.99% APR compounded daily, the EAR paid on a stable remainder over i twelvemonth becomes thirteen.87% (encounter credit card interest for the .000049 addition to the 12.99% April). Note that a loftier U.S. APR of 29.99% compounded monthly carries an effective annual rate of 34.48%.

While the difference between APR and EAR may seem trivial, considering of the exponential nature of interest these small differences can have a large issue over the life of a loan. For example, consider a 30-year loan of $200,000 with a stated APR of 10.00%, i.e., ten.0049% Apr or the EAR equivalent of x.4767%. The monthly payments, using April, would be $1755.87. However, using an EAR of 10.00% the monthly payment would be $1691.78. The difference between the EAR and Apr amounts to a departure of $64.09 per month. Over the life of a 30-year loan, this amounts to $23,070.86, which is over xi% of the original loan amount.

Certain fees are not considered [edit]

Some classes of fees are deliberately not included in the calculation of April. Because these fees are not included, some consumer advocates claim that the Apr does not represent the full toll of borrowing. Excluded fees may include:

- routine one-fourth dimension fees which are paid to someone other than the lender (such as a real manor attorney's fee).

- penalties such equally late fees or service reinstatement fees without regard for the size of the penalty or the likelihood that it will be imposed.

Lenders argue that the real estate attorney's fee, for example, is a pass-through cost, non a price of the lending. In outcome, they are arguing that the attorney's fee is a separate transaction and not a part of the loan. Consumer advocates contend that this would be true if the customer is free to select which attorney is used. If the lender insists, notwithstanding, on using a specific chaser, the price should be looked at as a component of the full cost of doing business with that lender. This area is made more than complicated by the practice of contingency fees – for example, when the lender receives coin from the attorney and other agents to exist the 1 used past the lender. Because of this, U.S. regulators require all lenders to produce an affiliated business concern disclosure form which shows the amounts paid between the lender and the appraisal firms, attorneys, etc.

Lenders debate that including late fees and other conditional charges would crave them to brand assumptions about the consumer's behavior – assumptions which would bias the resulting adding and create more confusion than clarity.

Not a comparable standard [edit]

Even beyond the non-included cost components listed above, regulators have been unable to completely ascertain which former fees must be included and which excluded from the calculation. This leaves the lender with some discretion to make up one's mind which fees will be included (or not) in the adding.

Consumers tin can, of course, utilise the nominal interest charge per unit and any costs on the loan (or savings account) and compute the APR themselves, for instance using one of the calculators on the internet.

In the example of a mortgage loan, the following kinds of fees are:

| Generally included | Sometimes included | Generally not included |

|---|---|---|

|

|

|

The discretion that is illustrated in the "sometimes included" column even in the highly regulated U.Southward. home mortgage surroundings makes it difficult to simply compare the APRs of two lenders. Note: U.S. regulators generally require a lender to use the same assumptions and definitions in their calculation of APR for each of their products fifty-fifty though they cannot force consistency across lenders.

With respect to items that may be sold with vendor financing, for case, car leasing, the notional toll of the good may effectively be hidden and the APR subsequently rendered meaningless. An example is a instance where an automobile is leased to a customer based on a "manufacturer'southward suggested retail price" with a low Apr: the vendor may exist accepting a lower lease rate equally a trade-off against a higher sale toll. Had the customer self-financed, a discounted sales price may have been accepted by the vendor; in other words, the customer has received inexpensive financing in commutation for paying a higher purchase price, and the quoted APR understates the true cost of the financing. In this case, the only meaningful way to establish the "true" Apr would involve arranging financing through other sources, determining the everyman-acceptable greenbacks toll and comparison the financing terms (which may not be viable in all circumstances). For leases where the lessee has a purchase option at the stop of the charter term, the toll of the APR is further complicated by this option. In effect, the lease includes a put option dorsum to the manufacturer (or, alternatively, a phone call option for the consumer), and the value (or cost) of this choice to the consumer is non transparent.

Dependence on loan period [edit]

APR is dependent on the fourth dimension period for which the loan is calculated. That is, the APR for a 30-year loan cannot exist compared to the APR for a twenty-year loan. April tin can be used to evidence the relative impact of different payment schedules (such as airship payments or biweekly payments instead of directly monthly payments), only most standard APR calculators have difficulty with those calculations.

Furthermore, most Apr calculators assume that an individual will go on a particular loan until the end of the defined repayment period, resulting in the up-front stock-still closing costs being amortized over the full term of the loan. If the consumer pays the loan off early, the effective interest rate achieved will be significantly college than the Apr initially calculated. This is specially problematic for mortgage loans, where typical loan repayment periods are fifteen or xxx years but where many borrowers movement or refinance before the loan menstruation runs out, which increases the borrower's constructive toll for whatever points or other origination fees.

In theory, this factor should non affect any individual consumer's ability to compare the April of the same product (same repayment catamenia and origination fees) across vendors. APR may not, nonetheless, be particularly helpful when attempting to compare different products, or similar products with unlike terms.

Interest-only loans [edit]

Since the principal loan balance is not paid down during the involvement-just term, assuming there are no fix costs, the APR will be the same as the involvement rate.

3 lenders with identical data may still calculate dissimilar APRs. The calculations tin can be quite complex and are poorly understood even by most fiscal professionals. Most users depend on software packages to calculate April and are therefore dependent on the assumptions in that particular software package. While differences betwixt software packages will not result in large variations, there are several acceptable methods of calculating APR, each of which returns a slightly different upshot.

See also [edit]

- Chemical compound involvement

References [edit]

- ^ "EUR-Lex - 51996AC1091 - EN". eur-lex.europa.eu.

- ^ "Justice and Consumers". European Committee - European Commission.

- ^ a b c d "Subject: Regulation AA", Alfred F."Bob" Blair, Jr., United states Federal Reserve, 2008-06-28, webpage: US-Federal-Reserve-R1314.

- ^ O'Sullivan, Arthur; Steven K. Sheffrin (2010). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Prentice Hall. p. 514. ISBN0-xiii-063085-3.

{{cite book}}: CS1 maint: location (link) [ dead link ] - ^ "The Financial Literacy Crisis", April 2008, US News and Earth Report, webpage: USNews-Your-Money-101.

- ^ "President's Informational Council on Financial Literacy", January 2008, Rossputin.com, webpage: Rossputin-FinLiteracy.

- ^ "Margill – Loans, Lines of credit, Apr" (calculation types), Margill/Jurismedia inc., 2008, webpage: Margill-en.

- ^ https://web.archive.org/web/20051103034219/http://www.uncdf.org/mfdl/readings/EIR_Tucker.pdf Tucker, William R. "Effective Interest Charge per unit," Paper, Bankakademie Micro Cyberbanking Competence Center, 5–6 September 2000.

- ^ "Justice and Consumers". European Commission - European Commission.

- ^ "DIRECTIVE 2008/48/EC OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 23 April 2008 on credit agreements for consumers and repealing Council Directive 87/102/EEC". 2008-05-22. Retrieved 2018-01-22 .

- ^ Reed, Philip. "Leasing Glossary". Archived from the original on 17 April 2008. Retrieved 2008-03-18 .

- ^ Money Gene Definition, efunda Engineering Fundamentals

- ^ Monthly Lease Payments, leaseguide.com

External links [edit]

- Catechumen an Effective Interest Rate to a nominal Annual Percentage Rate

- Convert a nominal Annual Percent Rate to an Effective Interest Charge per unit

- FDIC Finance Charge and APR adding rules

- http://world wide web.investopedia.com/terms/a/apr.asp

- White Paper: More than Math, The Lost Fine art of Interest calculation

- Introduction to percentages and agreement April with BBC raw money

- Mortgage Disclosure Comeback Human action or MDIA

- How to Summate Annual Percent Rate (APR) past Self [ permanent expressionless link ] , British Lenders

Source: https://en.wikipedia.org/wiki/Annual_percentage_rate

0 Response to "What Is Home Agains Current Annual Fee?"

Post a Comment